What Is Industrial Real Estate? A Complete Guide

- Arbor Realty

- Apr 10

- 6 min read

Updated: Aug 14

When you think about real estate, your mind probably jumps to cozy homes, sleek office buildings, or bustling shopping centers. But lurking behind every online purchase, every stocked grocery shelf, and every product rolling off the assembly line is a less glamorous yet vital type of property: industrial real estate.

As the global economy continues to evolve, the significance of industrial real estate is becoming increasingly apparent. These properties play a crucial role in supporting supply chains, fueling innovation, and creating jobs—they're essential pieces of the world’s infrastructure. In this blog, we’ll dive into what industrial real estate is, look at the different types out there, discuss its impact on the economy, highlight current market trends, and see how it stacks up against commercial real estate.

Importance of Industrial Real Estate

The significance of industrial real estate has surged, particularly with the rise of technology and the boom in global e-commerce. Here’s why it’s so crucial:

1. Backbone of the Supply Chain

Industrial real estate is essential for the storage and movement of goods. Without warehouses, factories, and distribution centers, our modern supply chains would come to a standstill.

2. Enabler of E-Commerce

As online shopping continues to grow, the need for fulfillment centers, last-mile delivery hubs, and return-processing facilities has skyrocketed. Industrial real estate is the backbone of logistics that enable speedy one-day shipping.

3. Job Creation & Economic Growth

Industrial properties are home to a diverse array of businesses that employ millions globally, from factory workers to logistics managers. They play a vital role in driving regional economic development.

4. Investment Stability

Industrial assets often come with long-term leases, low vacancy rates, and high tenant retention. This makes them attractive to investors looking for stable, income-generating real estate.

5. Support for Innovation

Modern sectors like biotechnology, renewable energy, and advanced manufacturing need specialized facilities. Industrial real estate is adapting to cater to the demands of these cutting-edge industries.

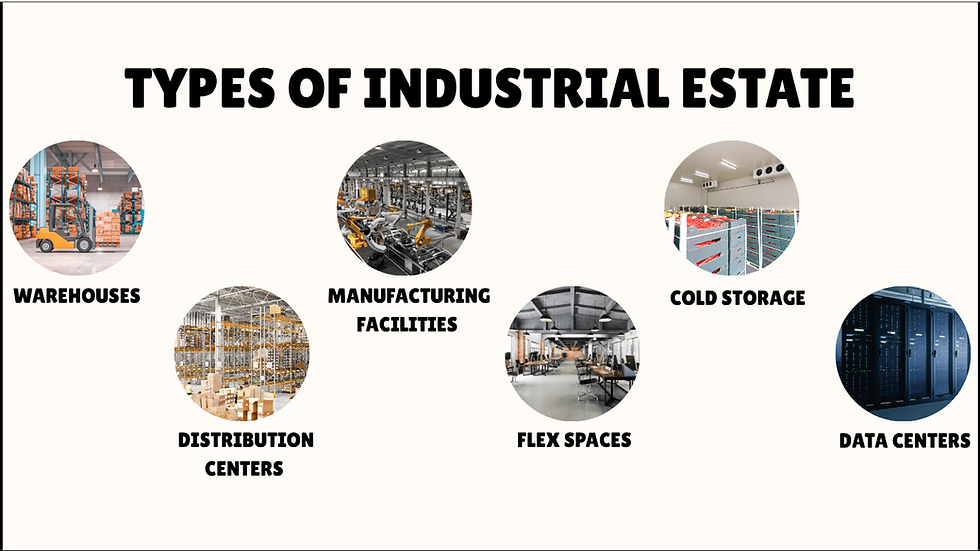

Types of Industrial Real Estate

Industrial real estate isn’t a one-size-fits-all kind of deal. It encompasses a variety of subtypes, each tailored for specific industrial activities. By grasping the different types of industrial real estate, investors, developers, and business owners can make smarter, more informed choices.

1. Warehouses

These spacious facilities are designed to store goods before they make their way to retailers or consumers. They can range from temperature-controlled environments to simple dry storage.

Common Features:

Expansive open areas

Loading docks

Proximity to highways or ports

2. Distribution Centers

While they share similarities with warehouses, distribution centers are fine-tuned for the rapid movement of goods. These facilities play a vital role in today’s e-commerce landscape and just-in-time delivery systems.

Common Features:

Cross-docking systems

Automated sorting technology

24/7 operational capabilities

3. Manufacturing Facilities

These spaces are dedicated to producing goods and can be classified as light or heavy industrial properties, depending on the manufacturing processes involved.

Light Manufacturing: Think assembly, packaging, and small-scale production.

Heavy Manufacturing: This includes steel mills, car factories, and chemical plants—often custom-built and requiring substantial infrastructure.

4. Flex Spaces

Flex spaces blend office and industrial functions, making them perfect for small businesses that need both administrative and operational areas under one roof.

Common Features:

Front office space

Back warehouse or production area

Interiors that can be easily adapted

5. Cold Storage

With the rising demand for fresh food delivery and pharmaceuticals, cold storage facilities are on the rise. These specialized spaces are temperature-controlled to meet specific needs.

Common Features:

Freezers and refrigerators

Advanced insulation

Humidity and air quality management

6. Data Centers

While they might not fit the traditional mold of industrial spaces, many experts now consider data centers part of the industrial real estate landscape due to their heavy infrastructure and non-retail functions. They’re essential for storing and processing data for everything from cloud computing to streaming services.

Market Trends in Industrial Real Estate

As we look ahead to 2025, the industrial real estate market is shaping up to be a dynamic sector, fueled by innovation, urban growth, and global trade. Here are some key trends to keep an eye on:

1. E-Commerce Expansion

The surge in e-commerce, which was supercharged by the pandemic, is still driving a huge demand for logistics and distribution centers. Retailers are now on the hunt for multiple warehouses that are strategically placed to cut down on delivery times.

2. Last-Mile Delivery Facilities

In urban areas, there’s a noticeable increase in smaller industrial spaces dedicated to last-mile delivery. This crucial step in the supply chain ensures that goods reach consumers more quickly.

3. Automation & Smart Warehousing

Industrial spaces are embracing technology, integrating AI, robotics, and the Internet of Things (IoT) to boost operational efficiency. Features like automated sorting, self-driving forklifts, and real-time inventory tracking are becoming the norm.

4. Sustainability

The push for green buildings is gaining momentum. With solar panels, energy-efficient lighting, rainwater harvesting, and eco-friendly construction materials, traditional warehouses are being transformed into sustainable assets.

5. Shift Toward Smaller, Urban Facilities

Developers are increasingly focusing on building smaller facilities closer to where people live. While large warehouses still play a significant role, there’s a rising interest in compact facilities that support urban logistics.

6. Rising Rents and Low Vacancy

Industrial real estate is outpacing other sectors, with strong demand keeping vacancy rates low and rents steadily climbing in major logistics hubs.

Commercial Real Estate vs. Industrial Real Estate

When it comes to real estate, commercial and industrial properties represent two unique slices of the market, each catering to different business needs. Commercial real estate is all about spaces that engage customers—think retail shops, office buildings, hotels, restaurants, and shopping centers. These venues are designed to draw in foot traffic and create a welcoming atmosphere for clients and employees alike.

On the flip side, industrial real estate is geared towards the nuts and bolts of operations, covering areas like manufacturing, warehousing, storage, and distribution. You’ll typically find these properties in industrial zones or close to transport hubs, built with functionality in mind—think open layouts, high ceilings, loading docks, and robust utilities.

While commercial properties often have shorter lease terms and experience higher tenant turnover, industrial spaces tend to enjoy longer leases, lower vacancy rates, and steadier income. Plus, building and maintaining industrial real estate is usually less costly, making it a more appealing choice for investors looking for long-term gains. Both sectors play a vital role in the economy, but they really do differ in design, location, tenant profiles, and investment strategies.

Conclusion:

As the global economy keeps evolving towards quicker, smarter, and more efficient systems, grasping the importance of industrial real estate is becoming more crucial than ever. From manufacturing facilities to last-mile delivery hubs, this sector is the driving force behind the scenes, serving as a fundamental element of modern logistics, e-commerce, and production.

At Arbor Realty, we understand the increasing importance and changing trends in this essential industry. Whether you’re an investor on the lookout for fresh opportunities, a business in search of the perfect operational space, or a professional navigating the real estate landscape, Arbor Realty is here to be your reliable partner in tapping into the potential of industrial real estate. With our expert insights, customized solutions, and a focus on delivering value, we empower you to make well-informed decisions in a constantly shifting property market.

Frequently Asked Questions

Q: Is industrial real estate risky?

Industrial real estate can come with its fair share of risks, like market ups and downs, economic slumps, high vacancy rates, and demand that varies by location. But if you do your homework and secure long-term leases, it can provide a steady income and lower management costs compared to other types of investments.

Q: Is industrial real estate a good investment for beginners?

Yes. With the right support and planning, even first-time investors can benefit from the stable returns and long leases that industrial properties offer.

Q: How much money do I need to invest in industrial real estate?

It depends on the size and location of the property. Some small warehouses may be affordable, while large manufacturing sites require more capital. Financing options and joint ventures can also help reduce the upfront cost.

Q: What’s the biggest challenge with industrial real estate?

Finding the right location and dependable tenants. A poor location or high tenant turnover can lead to losses. Partnering with a trusted real estate service provider helps reduce risks through expert guidance and market insights.

コメント